A virtual card, also known as a digital card or cloud card, is a set of 16 digits randomly generated together with a CVV code. Each virtual credit card number is a unique token that can be used to make a one-time purchase of goods and services. The built-in security features have made virtual cards a popular payment method for commercial Buyers. Virtual cards replace paper checks, static cards, or ACH for invoiced purchases.

Efficient virtual card acceptance for you and your customers

Simplify virtual credit card payments processing and reconciliation with ease and increase efficiency to accomplish more.

Versapay Virtual Card Connect drives efficiency, accelerates cash flow, and delivers a better payment experience for your customers. And, it works with other Versapay products.

Offer more payment methods to meet your customers' evolving needs

Simplify the payment process and improve overall customer satisfaction by offering a variety of payment options, including B2B virtual card payments.

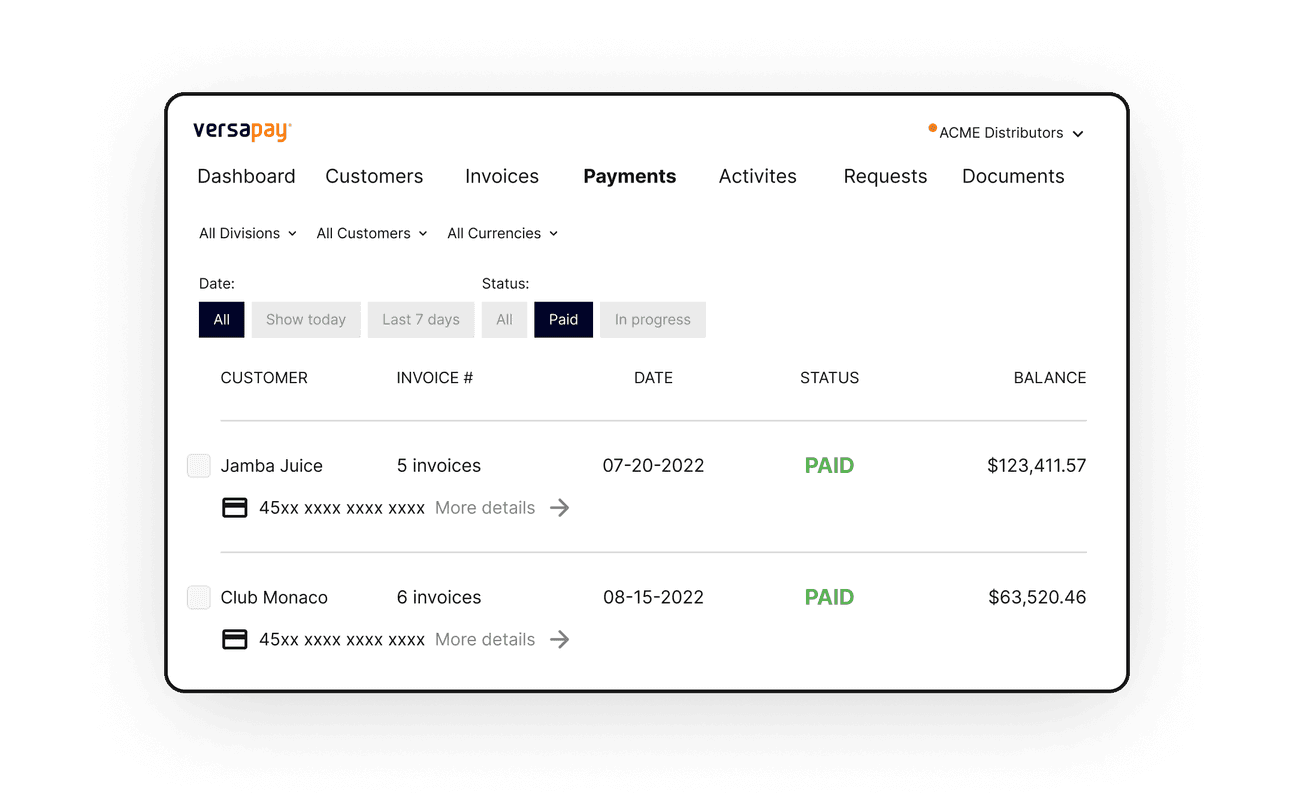

Eliminate costly manual workflows

Say goodbye to time-intensive processes. Virtual Card Connect automatically processes incoming emails, parses remittance and card number details, and processes the payments. Straight-through payment processing technology, powered by Boost Payment Solutions, increases match accuracy rates for payment parsing.*

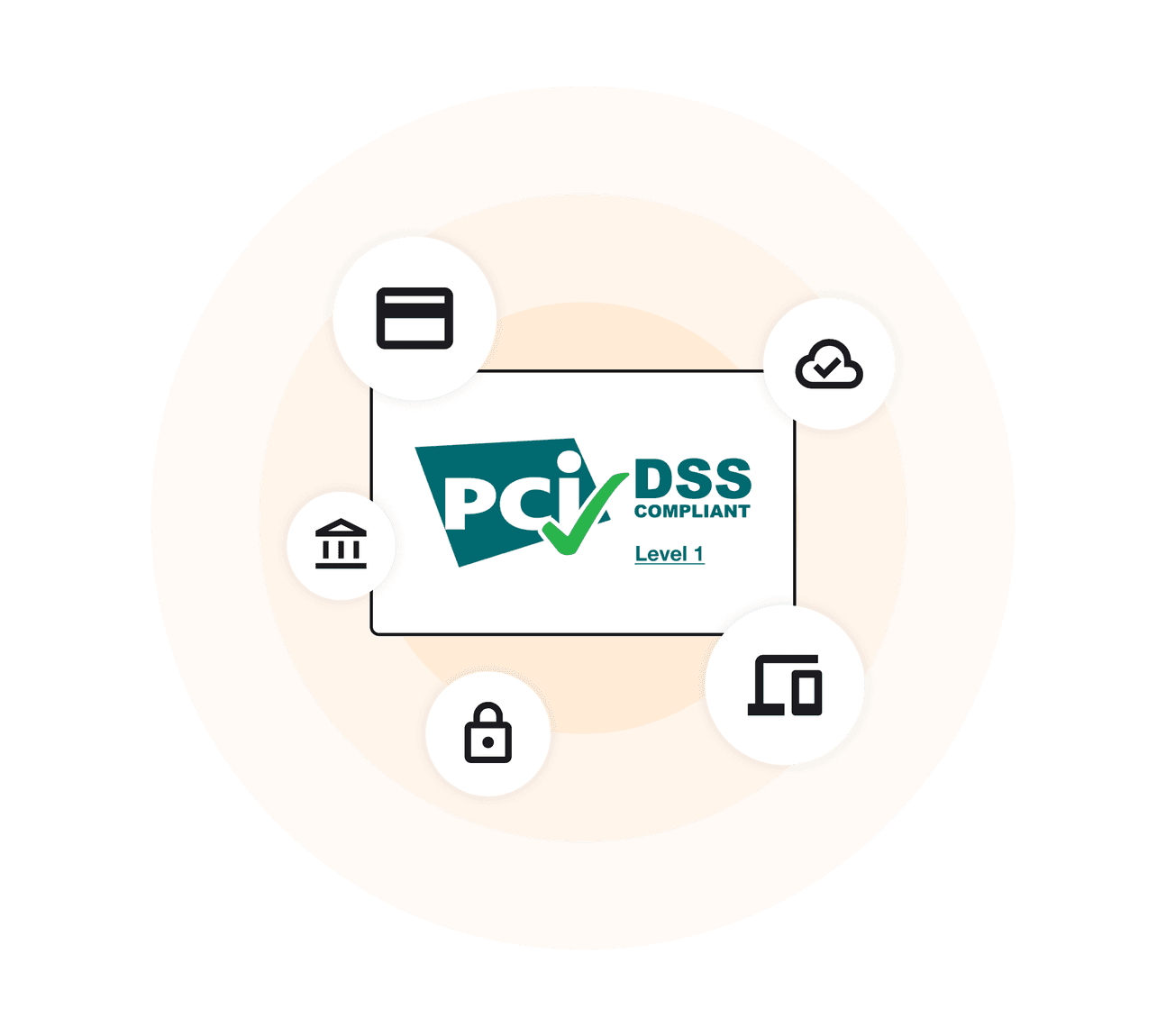

Find peace of mind with secure payment acceptance

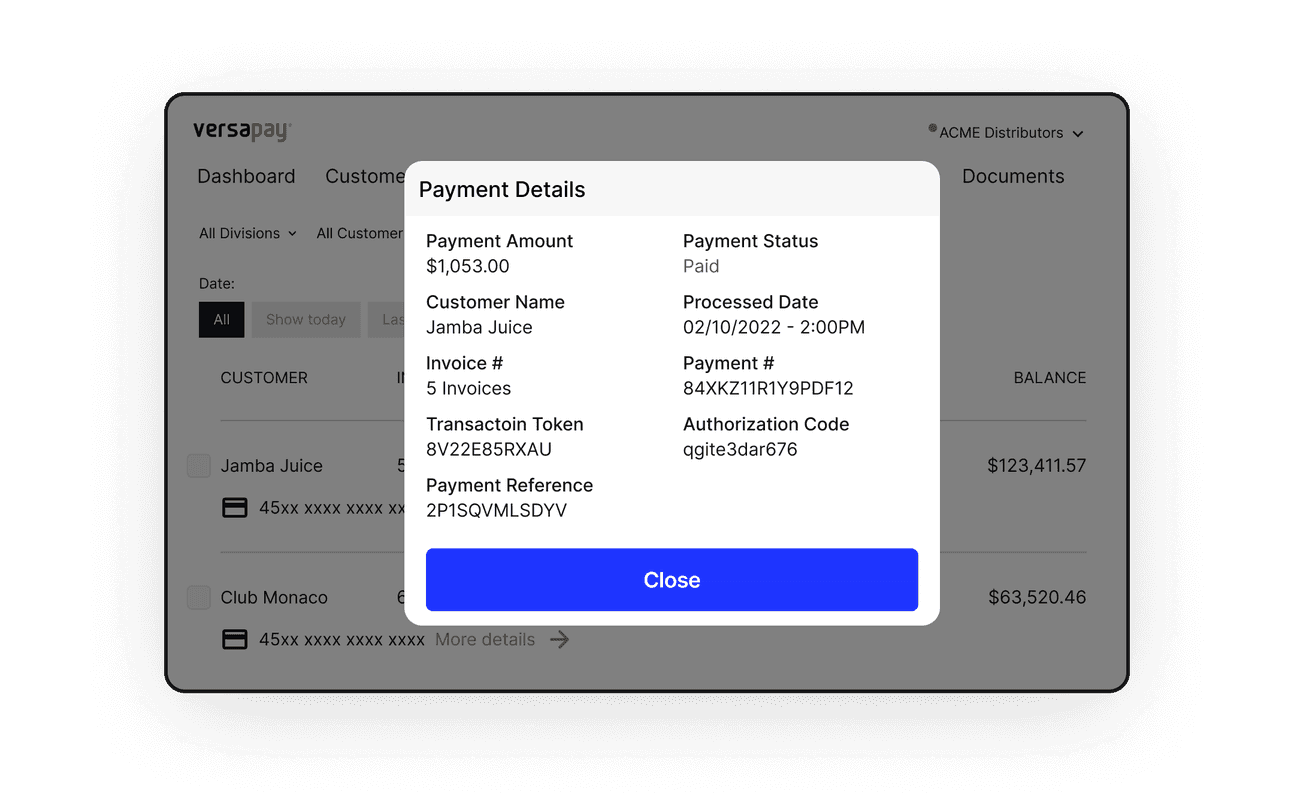

Safely collect payments with Versapay’s PCI DSS compliant payment processing solutions that help minimize fraud and chargeback risks. Your business remains safe as all your customers’ payments are tokenized and encrypted for a more secure payment experience.

Discover why virtual card acceptance is so critical

Learn more about virtual credit card acceptance and the benefits of automated virtual card processing for B2B merchants.

Accelerate cash flow with faster processing

Get touch-free, straight-through payment processing for virtual cards at rates optimized for B2B transactions with interchange optimization and Level 3 data processing.

Automate reconciliation and reporting

Streamline ERP reconciliation with access to detailed virtual card reporting data that can be scheduled and exported directly to your ERP.

With our integrated solutions for ERP Payments and Collaborative AR, ERP reconciliation with open AR is fully automated.

Accepting Virtual Credit Cards is Business Critical. Are You Ready?

Customers want to pay with virtual cards, and over half are willing to switch vendors if you don't provide that option. This study shows why virtual cards are becoming increasingly critical and how you can turn them into a competitive advantage.

*Boost Intercept® straight-through processing is a patented solution provided by Boost Payment Solutions. All related names and logos are registered trademarks owned by Boost Payment Solutions, Inc.

Virtual credit card FAQs

The virtual card payment information is typically emailed or faxed to a supplier via a virtual card platform tied to the Buyer’s accounts payable system. Emailed virtual card payments may require login credentials and additional security measures may be imposed. The card information is manually entered by the supplier into a credit card terminal and processed and remittance information is manually posted to AR systems.

Virtual credit card processing software eliminates time-consuming, labor-intensive, and error-prone data entry associated with emailed virtual card payments. It automatically processes incoming emails and parses remittance and virtual card number details. Straight-through payment (STP) automates the end-to-end processing of parsed payment transactions, accelerating cash flow.

Virtual credit card acceptance offers many benefits:

- Faster payment processing time compared to checks

- Issuers guarantee the virtual card payment

- Minimized risk of fraud helps avoid chargebacks

- Better payment experience for buyers

That’s just the start. You can find other virtual card payment processing benefits in this guide.

The following are just a few of the challenges virtual credit cards solve:

- Takes too much work to manually process and reconcile emailed virtual credit card payments

- Unprotected payment processes and PCI data exposure

- High costs associated with interchange and payment processing

- Manual data entry errors

- Delayed payments

- More secure than physical credit cards thereby reducing fraud risk

- Make expense management easier with detailed spending tracking

- Help improve cash flow with control over when payments are initiated and cleared

- Provide cash-back rebates on qualifying virtual card payments from issuers

Virtual credit card automation software delivers several unique features:

- Eliminates manual handling and processing of virtual card emails

- Reduces errors and accelerates payment processes

- Automatically reconciles virtual card payments with open accounts/invoices

- Increases protection of your sensitive payment data and minimizes exposure to fraud risk

STP is a mechanism that automates the end-to-end processing of transactions.

For commercial card or virtual card payments, STP enables an Issuer or Buyer to push card payments directly to a Supplier's acquiring bank, eliminating the manual entry of card information traditionally received via email or fax.